Make the IRS Your Last Beneficiary - Not Your Biggest One!

For North Texas Couples with $250,000 + in Qualified Assets such as 401(k)s, IRAs, and 403 (b)s

Discover how smart Dallas-Forth Worth retirees are protecting principal, eliminating future tax surprises, avoiding out-of-pocket conversion taxes, and creating future tax-free income using our proven Roth Conversion Strategy.

Why Retirees Are Acting Now

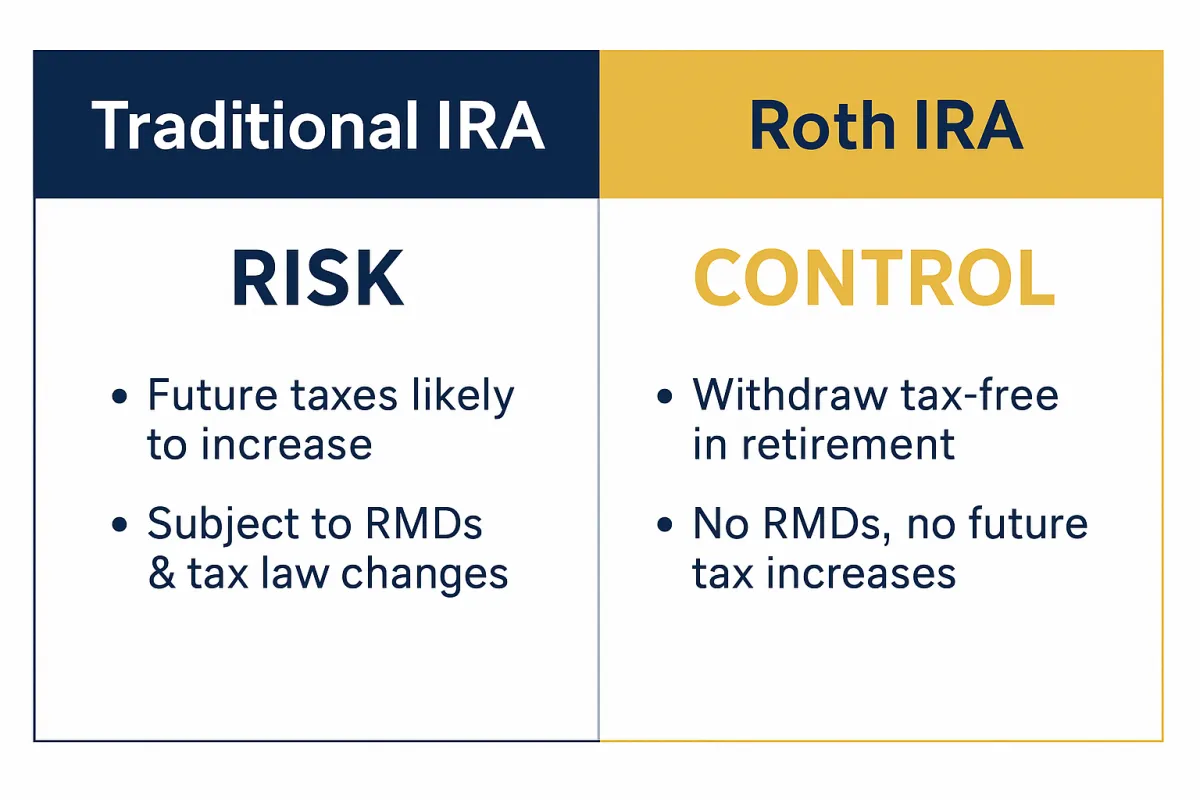

Every dollar withdrawn from your IRA/401(k)/403(b) is taxable. When today's lower rates sunset, retirees could pay significantly more to the IRS. There is a way to lock in current low marginal rates and convert safely - without paying the taxes out of your pocket.

Avoid surprise tax bills in retirement

Avoid higher tax brackets later in retirement

Protect your principal from market volatility and downturns

Eliminate future required minimum distributions (RMD's)

Protect your heirs from potential legacy tax burden

Create a predictable future tax-free income stream

Every year you wait, more of your retirement becomes taxable forever

Every year you wait, the IRS becomes your biggest beneficiary (and you or your heirs keep less).

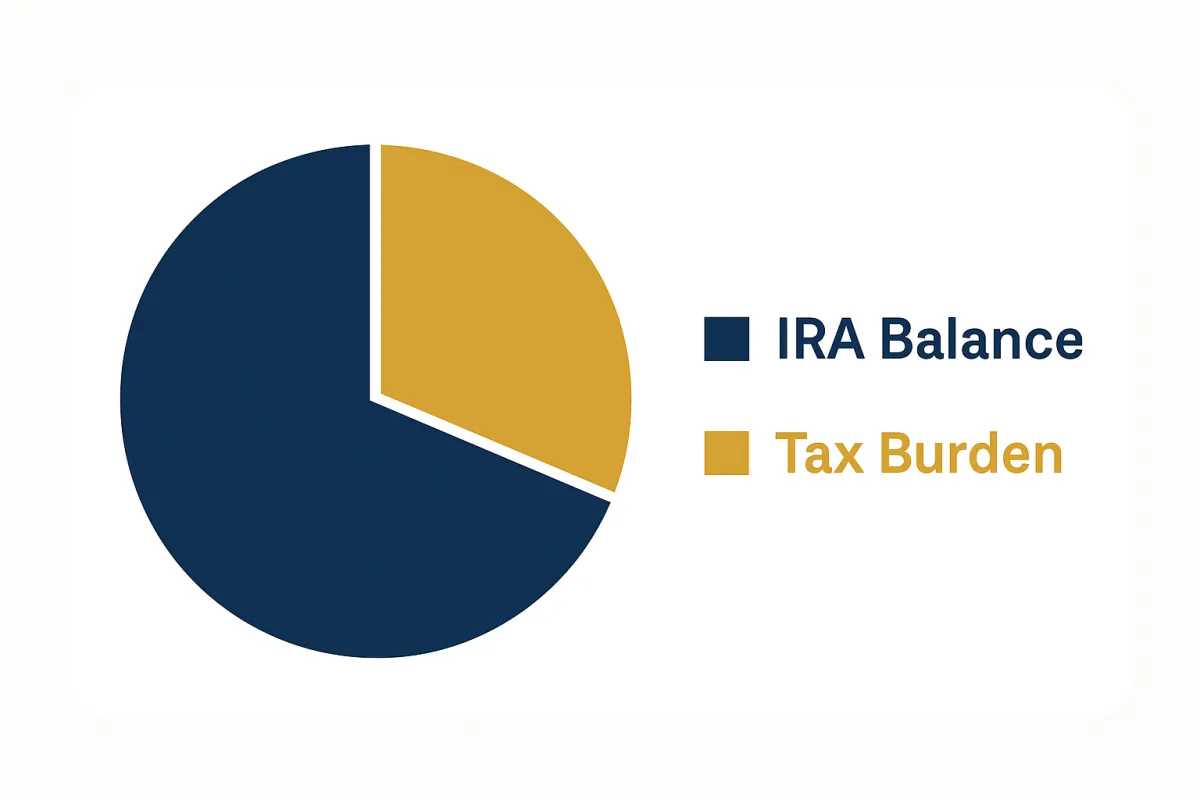

This is why most retirees overpay the IRS - Unintentionally

The Smart Roth Conversion Strategy Trusted by North Texas Retirees

Our approach helps you convert portions of your savings to tax-free income while using tax efficient funding so you don't have to pay the taxes out-of-pocket. Your principal stays protected!

Step 1: Analyze

We identify your tax bracket, conversion window, and ideal amount to convert each year — without paying taxes out of pocket.

Step 2: Implement

We help you reposition a portion of your IRA using strategies designed to minimize taxes and reduce future RMDs.

Step 3: Enjoy

You receive tax-free income in retirement and peace of mind knowing the IRS cannot increase taxes on converted funds.

See How Much Tax-Free Income You Could Create - In Under 2 Minutes

You’ll instantly learn whether a Roth Conversion could save you thousands in future taxes.

Takes less than 2 minutes. No Pressure. No obligation.

Meet Patrick Smith.

Trusted by 1000+ North Texas Families Since 1974

Patrick Smith is a North Texas-based Independent Advisor specializing in Tax-Free Income Strategies, Roth Conversions, and Retirement Planning for individuals ages 55–75+. For over 50 years, he has helped retirees reduce taxes, avoid market risk, and protect their lifetime income.

Why Patrick's Clients Choose Him:

Based in North Texas - understands local planning needs

Over 50 Years of Experience

Fiduciary approach to your plan since 1974

Expert in tax-free income strategies and risk elimination

Insurance backed guarantees

“Our mission isn’t simply to reduce your taxes — it’s to help you retire with confidence, clarity, and predictable lifetime income."

- Thomas Patrick Smith, Licensed Fiduciary since 1974

Featured on Wealth Awareness Radio

Licensed Fiduciary I Independent Advisor I Since 1974

Real Texans. Real Results. Real Tax Savings.

Pat Smith is a very knowledgeable financial planner. Over these past 7 years he has provided invaluable investment information. Pat is honest, respectful and personable.

- Steve J., Dallas, Texas

⭐⭐⭐⭐⭐

Google 5 Star Review

My wife and I have been clients of Bering Financial since 2016, and it was the best move we made to secure our financial future! Principal Patrick Smith and his associates have been a true partner. They opened our eyes to a style of investing not typically found among the sea of choices. Because of Bering, we have employed Roth conversions as a significant part of our retirement strategy. We also have long-term care insurance and comprehensive insurance annuities. Finally, Bering specializes and offers varied alternative investment options again, not typically offered by traditional investment firms, that offer higher returns coupled with liquidity.

Our net worth has increased dramatically since we came under their financial umbrella. I can recommend this firm to anyone without reservation.

-Stuart S., Grapevine, Texas

⭐⭐⭐⭐⭐

Google 5 Star Review

“Patrick ran our Roth Conversion analysis and helped us convert over three years without paying anything out of pocket. We now have predictable tax-free income for life.”

— John & Karen, Denton, TX

⭐⭐⭐⭐⭐

You're Not the Only One Asking Questions...

💡Will converting affect my Social Security or Medicare Taxes?

Because a Roth conversion increases your adjusted gross income (AGI), it can push you into higher provisional income ranges, meaning a greater portion of your Social Security benefits becomes taxable that year. Medicare Part B and Part D premiums are means-tested, based on your Modified Adjusted Gross Income (MAGI) from two years prior. If your Roth conversion causes your MAGI to exceed those thresholds, your Medicare premiums can increase by hundreds per month per person for the next year.

Those tax and Medicare effects are temporary — the conversion is taxed once, but future Roth IRA withdrawals are:

-Tax-free

-Do not count toward AGI

-Do not affect Social Security taxation

-Do not trigger higher Medicare premiums

So while a conversion may raise taxes and IRMAA in the short term, it can reduce future taxable income — keeping your Social Security benefits and Medicare premiums lower throughout retirement.

💡Is there any cost or obligation?

No. Your initial session is completely complimentary and designed to provide education — not a sales pitch. You’ll receive a personalized Roth conversion roadmap you can use whether you work with us or not.

💡Will I owe taxes immediately after converting?

Yes, conversions are taxable — but our strategy pays the tax due and helps minimize or offset those taxes using current deductions, smart timing, and other planning tools. Many clients are surprised how affordable it can be when structured correctly.

💡Can I still do this if I’m already retired?

Absolutely. In fact, many retirees are in their lowest lifetime tax bracket during early retirement — which makes it one of the best times to convert to a Roth and lock in tax-free growth for the rest of your life.

💡What if I already did a partial Roth Conversion before?

You can still convert additional amounts. In fact, many families benefit most when conversions are done in phases. Your personalized strategy will show the ideal conversion amount per year.

💡Does a Roth Conversion trigger an audit?

No. But many people think it does.

Take Control of Your Retirement- Let's Make Your Future Income Tax-Free

Every year you wait, your retirement taxes increase. See your numbers today.

Prefer to talk now? Call us directly at 817-767-2600

Bering Financial specializes in arming clients with knowledge and awareness about their money

that empowers them to make better financial decisions for their family and their future.

Thomas Patrick Smith (dba Bering Financial, LLC) is an Investment Advisory Representative of Legacy Wealth Management, LLC. Legacy Wealth Management, LLC is not affiliated with Bering Financial, LLC. Investment Advisory Services and securities are offered through Legacy Wealth Management, LLC, a registered investment advisor with the Securities and Exchange Commission (SEC):

Legacy Wealth Management, LLC

13965 W Chinden Blvd, Suite #100, Boise, ID 83713

No part of this communication should be construed as an offer to sell any security or provide investment advice or recommendation. Securities offered through Legacy Wealth Management, LLC will fluctuate in value and are subject to investment risks including possible loss of principal.

The information being provided is a courtesy. When you click on any link to another website provided herewith, you are leaving this site.

Bering Financial makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information and programs made available through this site. When you access one of these sites, you are leaving the Bering Financial website and assume total responsibility and risk for your use of these sites.

Information regarding securities issues and markets is obtained from sources believed to be reliable, but is not guaranteed as to accuracy, completeness, or fitness to a particular use. This website is intended solely to convey general information about the products and services provided by Bering Financial and is not investment advice or the solicitation for the purchase or sale of any security, product or service.

Licensed in TX I Fiduciary Advisor

Copyrights 2025 | Bering Financial I 1500 Corporate Circle Ste 11 Southlake, TX 76092